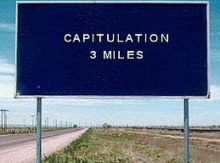

“Beware the Ides of March” – FOMC rate increase more likely after February’s US jobs data

“And standing here tonight, I’m afraid that I don’t hear – a – thing. Just… silence. …” John Tuld – Margin Call We are approaching what may prove to be a formative FOMC meeting on 15-16 March. After earlier macro growth fears out of China and a widening cadre of central bankers going full retard with NIRP, there […]

Continue reading