- Home /

- interest rates

Follow the money

Back in August of last year I highlighted the seemingly incongruous activity of corporate treasurers who had been raising record levels of new debt from bond issuances, notwithstanding the prevailing market ‘wisdom’ and recomendations that interest rates could only fall from those prevailing levels. Well, with long end bond maturies rising, including an approx +50bps […]

Continue readingJapanese MMT – the last domino to fall

Rising wage settlements and the falling Yen may have finally forced the Bank of Japan to reverse its negative interest rate policy, if recent media leaks ahead of its March meeting are to be believed. Behind this however, is the inexorable pressure to fund structural deficit spending when previous debt monetisations are cascading through into […]

Continue readingDeja Vu – but have the lessons been learned?

“Follow the Fed” has been a winning investment strategy, but that ought to be confined to what the central bank is actually doing rather than the narrative that it is trying to communicate. Since early December, that narrative has been plainly on offer, with Fed Chair Jerome Powell signalling a series of interest rate reductions […]

Continue readingUnited States can “certainly” afford to support wars on two fronts – Yellen

A runaway deficit already at around $2tn pa and rising interest rates as the US government is forced to compete for funds to pay for this and US Treasury Secretary Janet Yellen wants us to believe her administration can afford another war. For those bond funds already burned from believing her claims in 2021 that […]

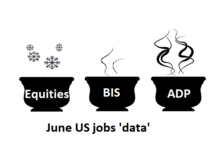

Continue readingJune US employment running warm, rather than hot – albeit a bit of a red herring for US Fed rates

If yesterday’s 10 year yield bounce to over 4% was a function of a more aggressive further interest rate rise by the Fed this month after the June ADP figures, then today’s cooler employment estimates for June from the BIS in its non-farm payroll figures may help dampen some of those fears. All this however, […]

Continue readingA very odd recession!

Oh what a wonderful recession it is. Perhaps this is just the Sitzkreig before the real impacts are felt, but for now the stats from US employment data has yet to support the widespread news narrative of layoffs as the BLS reports US net private sector job growth approaching +400k in January. Maybe the fear […]

Continue readingThe monster from the ID – inflation

The 1956 movie Forbidden Planet was at its core a tale of hubris; that technology can overcome nature, whether for Krell or human. The analogy for markets might be the conceit that the business cycle can be expunged without consequence and that one can borrow oneself out of debt. Like the ‘monster from the Id’ […]

Continue readingFog of war, or just fog?

Talk about fast markets. Blink and you might have missed WW3, as markets broadly return to where they were just 5 days ago. Good news however, may not be so positive for asset prices as waning emergencies mean fewer excuses by hard-up governments to keep printing their way out of deficits. And that means its […]

Continue reading