- Home /

- Economics

Bitcoin pyramid – a child of its time

There’s something almost comical about the law of unintended consequences. After nearly a decade of central bank intervention and manipulation of the market pricing of capital, should we be surprised that Bitcoin is now worth more than Proctor & Gamble? Having destroyed the market’s pricing of risk and replaced it with the moral hazard of […]

Continue readingUS September jobs data – never let a hurricane go to waste!

Never let a good hurricane go to waste. So when a couple turn up within a few weeks of each other (Harvey hitting Texas on 25th August and Irma skimming Western Florida on the 10th September) no one is going to take the estimated employment data for September as being particularly indicative of the underlying […]

Continue readingIf the Tories are heading for extinction, what next – Corbyn for PM?

Can it get much worse for Theresa May? Having botched an unnecessary general election, her grand solution to the Brexit negotiations is basically to try and do nothing. Having been sucked into the EU’s negotiating agenda of pay now, talk later on trade (or perhaps not at all), her ‘Florence’ proposal is now to seek […]

Continue reading“Carney warns fall in migrant workers could push up wages and inflation” – Doh!

“There’s an old saying. Don’t piss down my back and tell me it’s raining” (The Outlaw Josey Wales – 1976) The headlines, such as the one above from the Guardian may have juiced up the point a little, but underlying the attempted prevarication in his recent speech on Globalisation and inflation, this is pretty […]

Continue readingUS light vehicle sales for August

GM provided the standout in August, with its heavy incentives clawing back some of its earlier shortfalls in sales to deliver a +7.4% YoY improvement in domestic unit sales for August and bringing its YTD average to -2.4% and therefore slightly ahead of the overall industry’s -2.7% YTD decline as well as its principal domestic […]

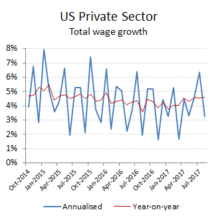

Continue readingUS wage growth slows in August

In between hurricanes, German elections, North Korean bomb and missile tests and the usual Jackson Hole navel gazing fest for central bankers, the August non-farm payroll estimates from the BLS may have struggled to make the front pages. At +165k, net private sector job additions for the month (+174k excluding movements in seasonal adjustments), it […]

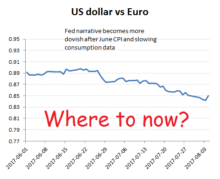

Continue readingUS adds +205k jobs in July – normally a positive for the US dollar, but now?

The problem of communicating a softening macro outlook is that it lowers interest rate expectations which in turn is a buy signal for not just investors, but also recruiters. So while the IMF cut its US GDP expectations for 2017 and 2018 by -20bps and -30bps respectively (both now to +2.1%) and currency markets have ‘drumfped’ […]

Continue readingP&G slashes digital spend with no impact – an ‘Oops’ moment for digital!

Those following Alphabet’s Q2 results may have noticed the changing mix driving revenues. While year-on-year organic revenue growth is still comfortably holding above +20% pa, it is increasingly driven by accelerating growth in paid clicks which are offsetting a higher rate of decline in the price per click that it receives. Given the auction basis […]

Continue reading