- Home /

- Economics

Zero bond yields are not without a cost. Mind the Gap!

Interesting article yesterday on Bloomberg reporting that billionaire Stan Druckenmiller has dumped equities in favour of US treasuries, where he sees 10 year yields dropping to zero over the next 18 months. The two big assumptions however, is that Trump won’t get re-elected in 2020 and that US yields will converge down to those in […]

Continue readingYield curve danger signals

A flattening yield curve is often taken as a bad omen for prospective GPD growth, so according to this theory, surely the increasing divergence in rates across the maturity range is good? Hmm, well actually no, as yields also diverged, while falling in the 2-3 quarters immediately preceding the last two recessions. Perhaps horse and […]

Continue reading(Earnings) Klingons on the starboard bow

Why are markets perennial optimists? Perhaps it’s a reflection of the commercial bias favouring a positive investment recommendation by market participants to portray a glass as half full rather than half empty. Fold in expectations of a central bank put to bail out markets with endless liquidity fixes when things get sticky and it’s easy […]

Continue readingQ1 GDP – too good?

Better than expected Q1 GDP growth in both China and the US, may not be as positive for asset prices as the initial market reaction might suggest. Not only does it dispel some of the more ambitious hopes for additional fiscal and monetary stimulus, but it also serves to encourage each side to dig in […]

Continue readingUS jobs growth – more mixed signals

Weak net job growth, but high average hourly wage growth in February has been followed by an improved rate of net job growth in March, but a weaker pace of increase in average hourly wages. The earth-shattering conclusion from all this is perhaps not to extrapolate a single month’s data as it may just get […]

Continue readingECB hopium

“substantial monetary policy stimulus remains essential to ensure the continued build-up of domestic price pressures over the medium term.” So says Sig Draghi in yesterday’s release of the ECB’s 2018 annual report and so much for any doubt that the ending of the asset purchase programme (AAP) in December would actually herald a return to […]

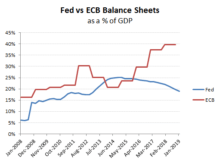

Continue readingMarket algos chasing Central Bank intervention, rather than anticipating it

Markets are going with the ‘flow’, because that’s the only way to trade these algo-driven markets. The new Fed chairman flip-flops from hawk to dove while the ECB hint at following suit (ahead of its May parliamentary elections) and the Chinese unleash another Tsumani of credit. Equity valuations meanwhile recoup the Q4 lost ground, notwithstanding […]

Continue reading1848?

BTFD or STFR depends on what game you think is really being played out there in markets. The recent bounce in equity prices on the apparent reversal in the Fed’s QT narrative together with an improving narrative on Chinese tariffs and now hopes for a reversal in Brexit, notwithstanding the resounding defeat of Theresa May’s […]

Continue reading