- Home /

- Economics

A warning signal to the EU/Euro as 10Y bond yield spreads widen

Markets may be focused on rising inflation and bond yields, but this doesn’t fully explain the forces at play here, or the potential ramifications. One of these can be seen by the diverging spreads in government bond yields as an enforced tightening monetary policy removes central bank ability to artificially suppress funding costs for the […]

Continue readingImpending jobs squeeze, or manipulated narrative?

It’s not too difficult to identify the potential storm clouds gathering on the economic horizon, so why is it that two of the largest investment banks feel the need to state the blindingly obvious over the past week? It is not as if either Goldman’s or JP Morgan are known for their philanthropy in offering […]

Continue readingThe monster from the ID – inflation

The 1956 movie Forbidden Planet was at its core a tale of hubris; that technology can overcome nature, whether for Krell or human. The analogy for markets might be the conceit that the business cycle can be expunged without consequence and that one can borrow oneself out of debt. Like the ‘monster from the Id’ […]

Continue readingRising Bond Yields & a Flattening Curve

A flattening yield curve is often seen as an ominous portend of economic doom, while a forced increase in interest rates can often ensure its delivery. This convergence however, is the conclusion of a tale that has been in the making for a couple of decades, but one where the inflationary consequences now threaten to […]

Continue readingFog of war, or just fog?

Talk about fast markets. Blink and you might have missed WW3, as markets broadly return to where they were just 5 days ago. Good news however, may not be so positive for asset prices as waning emergencies mean fewer excuses by hard-up governments to keep printing their way out of deficits. And that means its […]

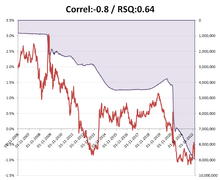

Continue readingUS Jobs data signal a shift in the monetary narrative

Oops, those betting on a weak US jobs report for January have been seriously wrong-footed. Instead of the expected negative figure, the BLS not only reported over +400k of net jobs in January, but a +649k upward revision to the jobs growth reported for the previous two months. Roll-in an average hourly wage inflation approaching […]

Continue readingWill the Euro replace the US dollar? – Unlikely!

It may not feel like it, but it’s over. What that means is that having failed to burn down the warehouse for the insurance, the business owners are now left in an even more precarious position of insurmountable liabilities, assuming of course there is no ‘unexpected’ collapse in life expectancy to bail them out from […]

Continue readingDecember US Jobs data again fiddled – all eyes on Fed asset purchases

This is getting repetitive! Once again, the BLS has reported a monthly US jobs estimate figure that has been artificially depressed by changing the seasonal adjustments. It is almost as if someone out there either doesn’t want the US to seem to return to normality, or is concerned that signs of a tightening job market […]

Continue reading